EARLIER this year on April 17, Alliance Bank Malaysia Berhad’s inaugural annual ESG survey report, ESG Insights from Malaysian SMEs: Building A Better Future Together revealed that three out of five Malaysian small and medium enterprises (SMEs) believe embedding environmental, social and governance (ESG) practices in their business will create long-term value, build a strong workforce and increase business opportunities.

The study was jointly commissioned with UN Global Compact Network Malaysia and Brunei (UNGCMYB) and SME Corporation Malaysia (SME Corp Malaysia) to provide insights on the awareness, adoption and challenges of SMEs striving to integrate ESG factors into business practices in Malaysia.

The study was developed using three approaches — in-depth interviews, a large-scale survey among 610 SMEs and secondary research.

Alliance Bank group chief executive officer Kellee Kam said: “As a bank that has a long-standing relationship with the SME sector, we understand the unique challenges businesses face. Locally, there is a lack of SME-centric frameworks and information to help small businesses on their ESG journey.

“As such, we launched this study to fill the gap in the market. We hope that our key findings, alongside our recommendations and tools, prove useful to SMEs who are looking to start or enhance their ESG journey,” Kam added.

The survey was launched as part of Alliance Bank’s ‘BeESG’ initiative to encourage more sustainable practices among businesses. Instead of viewing ESG as a compliance checklist, the bank hoped that this study’s findings will encourage businesses to take the opportunity to turn ESG practices into a source of competitive advantage.

According to the study, ESG adopters cited improving productivity, cost savings and brand reputation as the key motivation for including ESG practices in their strategy.

As for the non-ESG adopters, three key themes were identified for their hesitations towards adopting ESG — uncertainty about the impact of ESG, limited knowledge of ESG and financial constraints. However, this group of SMEs highlighted that financial support from banks, sponsored training and learning opportunities and tax incentives will facilitate their ESG adoption.

“At Alliance Bank, ESG is at the heart of our business strategy. We design our solutions around customers’ needs based on deep domain knowledge and this study enables us to personalise the solutions further. In our efforts to become a bank for the community, we want to support, and provide guidance and innovative solutions to help our customers embrace sustainable practices to be competitive and remain relevant,” Kam said.

“Our approach is defined by the 3As: ‘Advocacy, Advice and Answers’ — as we advocate ESG adoption, we are also working with strategic partners to advise SMEs on their ESG transition while we provide the suitable solutions as the answer to their constraints.”

Reflecting the financial institution’s endeavour to build an ESG-focused organisation, Alliance Bank offers an array of solutions that help SMEs build competitive advantages and achieve their sustainability goals. This includes green propositions through the Sustainability Assistance Programme for financial solutions, BizSmart Solution Portal and #SupportLokal for non-financial solutions.

UN Global Compact Network Malaysia and Brunei executive director Faroze Nadar also said, “As the backbone of our economy — serving as key drivers of job creation and economic development — SMEs can be important change agents helping to achieve a sustainable future for all. Alliance Bank is a valued partner in pushing forward the ESG agenda in Malaysia.

“Through our collaboration, we have been able to provide much needed support to companies, especially in helping SMEs transition to a more resilient and sustainable future. Together, we are taking a pragmatic approach by providing tools that will help SMEs to ensure sustainability performance and better navigate today’s ESG landscape,” Kam continued.

SME Corp Malaysia chief executive officer Rizal Nainy added, “Operating sustainably is not just a responsibility, it is an opportunity for SMEs to innovate and grow. By prioritising ESG practises, businesses can build a competitive advantage and enhance their brand image.

“It is imperative for Malaysian SMEs to embrace ESG to remain relevant and competitive in the domestic and global market. SME Corp Malaysia as the central coordinating agency for SME development sees a need to develop a holistic ecosystem to drive the sustainability agenda for SMEs including microenterprises.

“The PKSlestari initiative by SME Corp Malaysia envisages creation of the sustainability ecosystem of SMEs and I believe this report will complement this initiative, specifically in developing a policy framework to encourage and accelerate the adoption of ESG among SMEs.”

Alliance Bank also has an ecosystem of partnerships with industry leaders of ESG policymakers and certification bodies in order to develop programmes that encourage adoption of ESG.

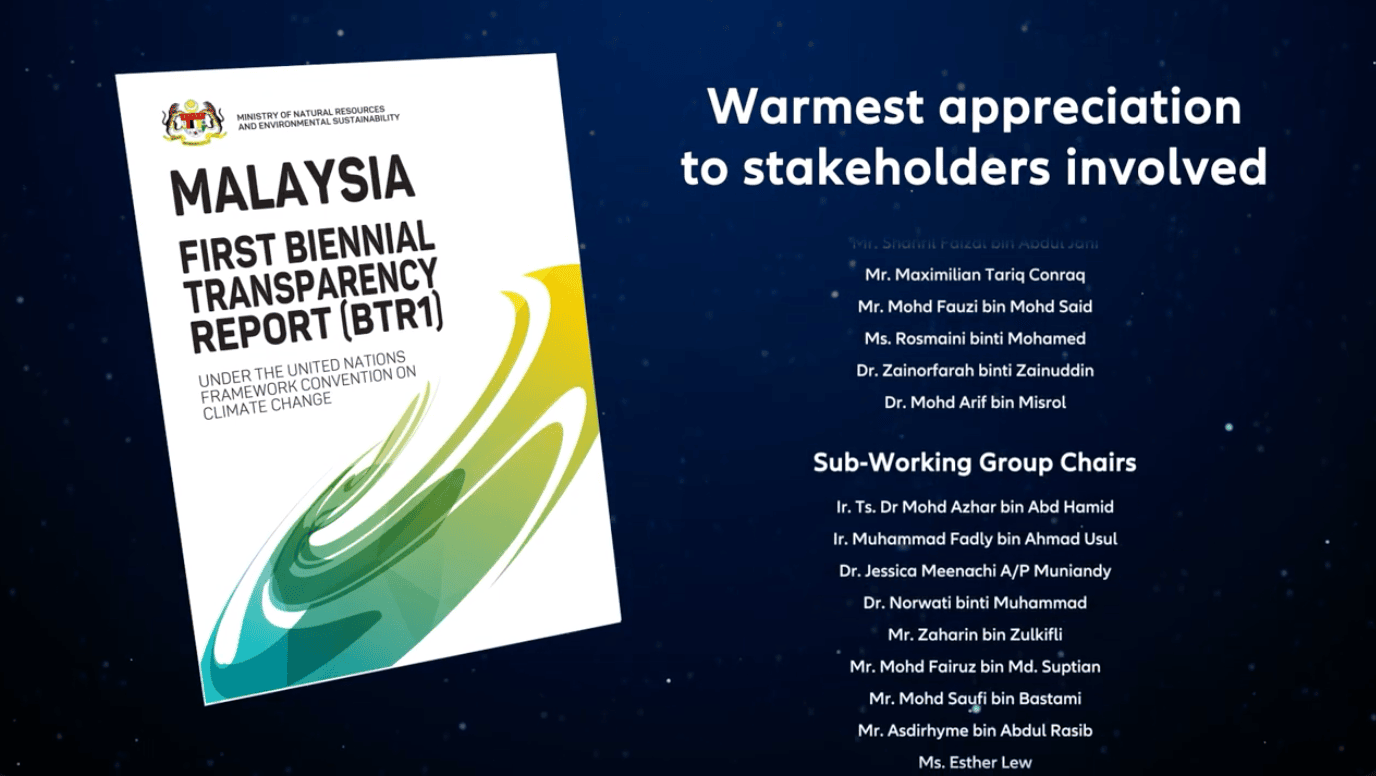

Apart from UNGCMYB and SME Corp Malaysia, the bank has also built alliances with other partners such as Bursa Malaysia and Malaysia Green Technology and Climate Change Corporation (MGTC) to provide professional consultancy and practical solutions that help businesses develop their ESG roadmaps.

As part of Alliance Bank’s sustainability agenda, the bank aims to grow RM10bil in new sustainable banking business by FY2025. To date, the bank has recorded RM6.7bil in new sustainable banking business.

Other findings of the study include:

> 78% of consumers make purchase decisions based on the products’ impact to the environment;

> One in four Malaysian SMEs has adopted elements of ESG practices in their business;

> 80% of ESG Adopters recognise the value of ESG adoption and plan to continue pursuing it moving forward;

> 39% of ESG adopters reported improved profits and cost savings from ESG practices;

> 76% of ESG adopters started their journey within the last 5 years; and

> 58% of non-ESG Adopters are open and keen to adopt ESG in the near future.

For more information on Alliance Bank’s ESG Survey and sustainability initiatives, please visit https://www.alliancebank.com.my/

Sumber: The Star