After taking into consideration how climate risks could impact its balance sheets, the Malaysia-based company diversified its businesses from the oil and gas sector and pivoted to green renewables. What lies behind the decisions it made?

Yinson’s Rising Bhadla solar plants project in Rajasthan, India. Image: Yinson

The oil and gas industry, as the largest contributor to climate change alongside coal, faces immense pressure in a changing energy economy. Its traditional business model is under pressure, yet it has had to navigate complex choices against the backdrop of great uncertainties about the type of energy transition activities that are viable, especially if companies in the industry want to be financially sustainable in the long term.

Yinson, a Malaysia-based energy infrastructure and technology company has taken into consideration how climate risks could impact its balance sheets and decided to diversify its businesses from the oil and gas sector. The company, which has its roots in transport and logistics, ventured into marine transport services in 2010 and then into chartering floating, storage and offloading (FPSO) vessels for offshore oil and gas production a year later. It is currently one of the largest independent FPSO leasing companies in the world. As major operators around the world start looking at how carbon emissions can be reduced in offshore production, Yinson sought to position itself as a market leader in driving the transition to clean energy and setting clear targets for net-zero emissions, aligned with the Paris Agreement.

In 2019, Yinson began to diversify into sustainability-focused industries, starting with renewable energy production with the setting up of Yinson Renewables. A year later, in 2020, Yinson ventured into green technology through another subsidiary, Yinson GreenTech, with a focus on e-mobility services. It looked into expanding and operating an electric vehicle (EV) charging infrastructure network in Malaysia, and conducting research on electrifying transportation at sea.

Yinson’s new business structure after adding its Renewables and Greentech units. Source: Yinson

Yinson has also taken steps to address its climate risks, having laid out a Climate Goals Roadmap. It targets to be carbon neutral by 2030 and achieve net-zero emissions by 2050. These goals are operationalised through a three-pronged framework, which involves carbon reduction, carbon removal and carbon compensation.

As the energy transition progresses, companies in the oil and gas industry have at their disposal an array of strategies to join the transition and de-risk their business. Some of these strategies might include diversification into and leveraging sustainable energy sources. Another key enabler for sustainability for the industry has been the emergence of green technologies, particularly the promise of viable carbon capture, utilisation and storage (CCUS) technologies which would allow for rapid drawdown of carbon in the atmosphere.

Yinson’s climate strategy capitalises on these opportunities by strategically expanding into the rapidly growing renewables and green technology industries, as well as employing low-carbon technologies in their existing assets.

Q & A with Yinson’s Head of Corporate Sustainability, Dr Renard Siew

We spoke to Dr Renard Siew, who leads corporate sustainability efforts at Yinson about the company’s journey in diversifying into renewables and green technology, and the challenges of managing climate risk.

Uncertainty about the future is a key challenge facing traditional oil and gas majors, and companies face inertia when deciding if they should diversify their energy operations. Before Yinson chose to pivot to green renewables, what were some of the key risk assessments that it looked into?

We did a benchmarking exercise on the environmental, social and governance (ESG) requirements of bankers and financiers, and observed that energy players were increasingly held to more stringent standards. This led to the conclusion that climate-related developments were going to pose both material financial and non-financial risks to the company. In 2021, we announced our support for the Taskforce on Climate-related Financial Disclosures (TCFD). In the same year, Yinson published our first climate report and was one of the first few Malaysian companies to publish a dedicated TCFD-aligned report.

The Report articulates very clearly our strategy and approach to managing climate-related risks. Adopting the TCFD recommendations, we have integrated climate-related risks into our existing Enterprise Risk Management (“ERM”) processes, with each climate-related risk having unique risk identification numbers. At the same time, Yinson conducts various risk assessments to identify our physical and transition risks. These include scenario analysis to help us navigate the future trajectory of transition and physical parameters. We believe that with every risk comes opportunity, so we wanted to leverage this and start looking at where the opportunities are along the energy transition spectrum.

Why did Yinson decide to invest in electric vehicle charging infrastructure? How does it see the EV landscape evolving in Malaysia?

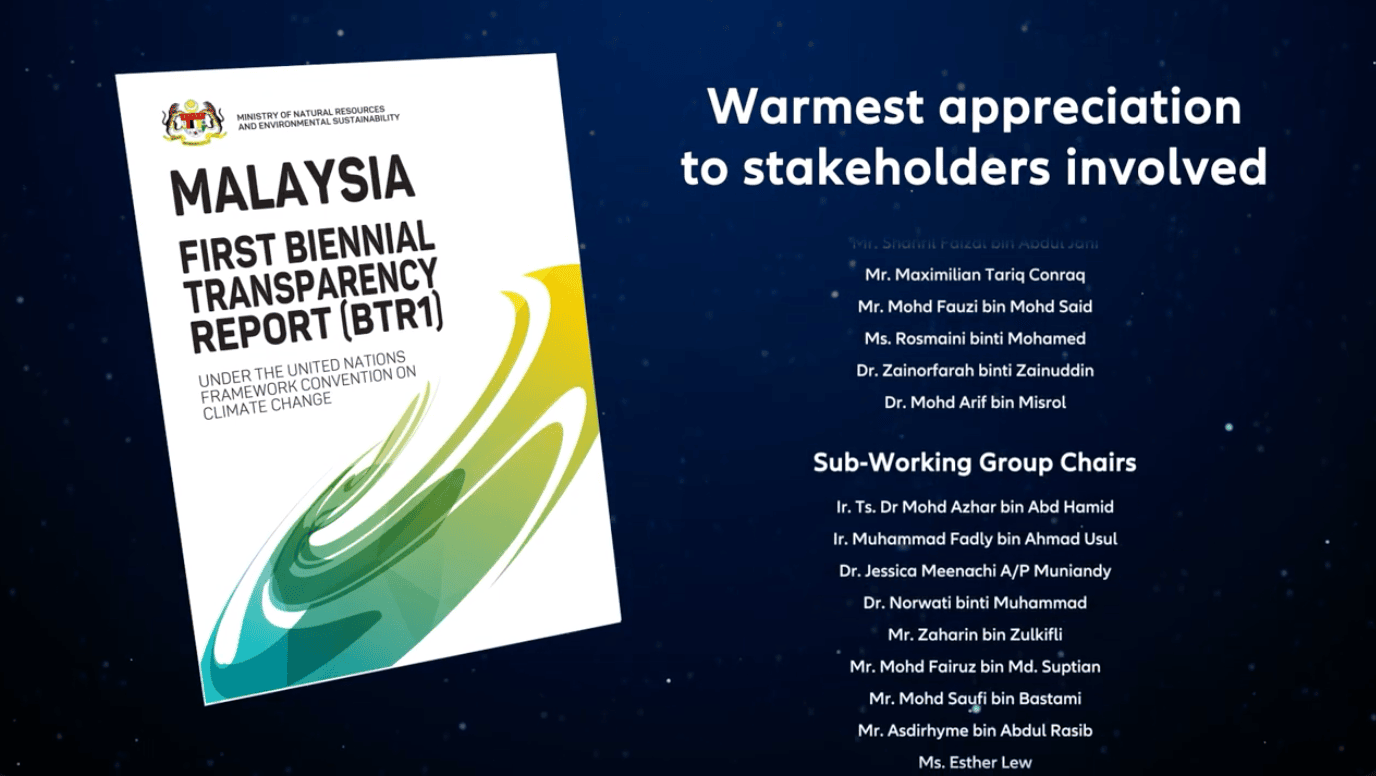

If you look at Malaysia’s breakdown of carbon emissions reported in the United Nations Framework Convention on Climate Change (UNFCCC) biennial report, you can see transportation makes up a large chunk of its emissions. This signals that the electrification of the nation’s transportation plays a vital role in decarbonisation.

Quite interestingly, Yinson was founded as a humble transport and logistics company, even as it subsequently expanded into the FPSO business. From 2019 onwards, the Group recognised the importance of business transformation and diversification while ensuring energy affordability and accessibility for everyone. In 2022, as part of embracing an inclusive energy transition, Yinson began making strategic investments into the EV charging infrastructure through its green technology solutions provider, Yinson GreenTech. We began by partnering with Malaysian Green Technology Corporation (MGTC) to help expand the installation of EV charging stations. In 2022, we took operational control of ChargeEV, and are proud to have expanded to become Malaysia’s largest EV charging network.

There are tremendous growth opportunities in this space. However, the challenge remains to get all key players to align on the decarbonisation approach. I believe we need a whole-of-government, all-of-society approach, ensuring we have the right policies in place and a conducive environment for private sector players to succeed in this business segment. In short, we need to set up an EV ecosystem to help Malaysia decarbonise its transportation sector.

Yinson Greentech’s DrivEV leases electric vehicles. Image: Yinson.

Yinson designs and operates production assets for the offshore oil and gas industry, but at the same time, it has adopted a ‘Zero Carbon FPSO’ concept. Why did it decide to do so? What are some of the challenges it took into consideration?

Yinson recently launched its “30 by 30” initiative, which details a set of material and aspirational ESG targets that it is looking to achieve by 2030. It also has in place a climate transition roadmap which articulates its aspirations to be carbon neutral by 2030 and net zero by 2050. The Zero Carbon FPSO concept is fundamental to achieving these goals.

We believe that Yinson is an early mover in the decarbonisation of FPSO operations, as articulated through this concept. To the best of our knowledge, we are ahead of our industry peers in terms of technology development and implementation.

I think the reality of the situation is that anything we do depends on the transition strategies of the countries in which we operate. In Malaysia, there is the possibility that we will still rely on natural gas as an interim base load fuel beyond 2040 as we phase out coal power plants. There will still be demand for oil and gas in the foreseeable future. It is important to keep operational emissions at their lowest. As we progress towards net zero in 2050, this is something that we have to look at closely and do what we can to play our part in decarbonisation.

Yinson’s ‘Zero Carbon FPSO’ approach

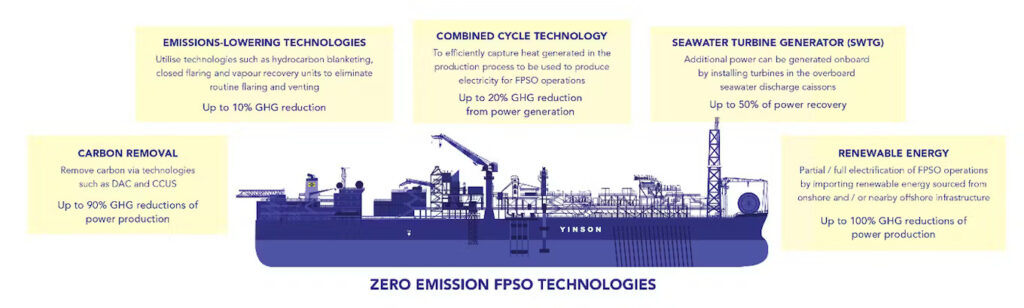

Key to Yinson’s climate transition roadmap is the concept of ‘Zero Emissions FPSO’, which involves employing technologies that will allow their offshore infrastructure to operate with minimal climate impact.

Offshore production, Yinson’s main business division, is currently the largest greenhouse gas contributor, making up around 97 per cent of the company’s overall carbon emissions in 2022. As such, Yinson’s climate strategy is focused on reducing emissions in the division, by employing technological solutions which can reduce operational emissions of its FPSOs.

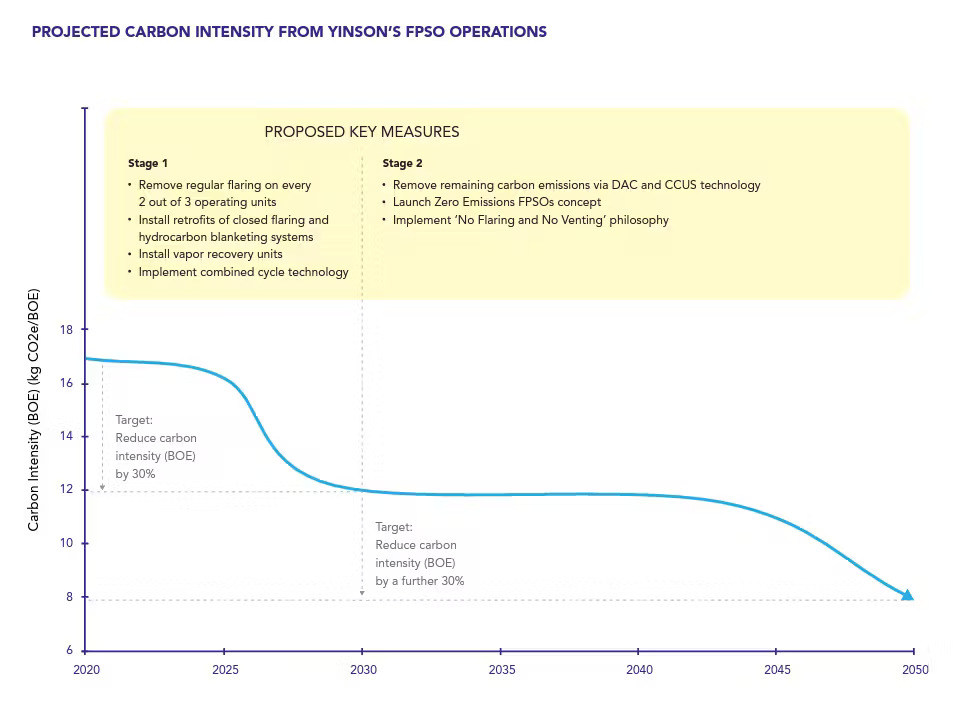

Yinson has divided its climate roadmap into two stages: Stage 1, which looks at the period up to 2030, and Stage 2, which is between 2030 and 2050. Even under a reduced carbon emissions pathway, Yinson’s forecasted emissions trajectory shows an upward trend in Stage 1, as it aims to reduce emissions intensity by 30 per cent through measures such as reducing flaring in the same period. Yinson has taken into consideration that for FPSOs that are already operational, installed technology onboard is likely to remain until the end of the contract period, and legacy FPSOs without emissions reduction technologies will continue to emit carbon at the current high intensities.

Yinson expects to begin rolling out its Zero Emissions FPSO by 2030 (Stage 2), where newly designed FPSOs will have emissions reduction technologies installed before beginning operations, with the aim of reducing carbon intensity by a further 30 per cent and removing the remaining carbon emissions using technologies such as direct air capture (DAC) and carbon capture, utilisation and storage (CCUS). Image: Yinson

In embarking on its diversification and decarbonisation strategies, how did Yinson get buy-in from key board members and stakeholders?

Our board and senior management have always been very supportive of our sustainability transition. They are staunch advocates because Yinson is in the energy industry. A lot of people are talking about the eventual phasing out of fossil fuels and there is rapid development surrounding the United Nations COP process and the need to mitigate and adapt to the impacts of climate change. Financiers and bankers now have more ESG requirements, and many have established policies on sustainable financing and are looking at introducing more stringent requirements on energy players. As we are involved in capital-intensive industries, we do have to rely on capital from our financiers to fund the construction of some of these projects. To a certain extent, we are compelled to embrace adaptation and prioritise longevity and sustainability so that Yinson will still be here for many years to come, which is why we embarked on the journey of setting up new divisions in renewables and green tech a couple of years back.

Yinson Renewables’ Nokh solar project. Image: Yinson.

How have shareholder expectations shifted, and how does Yinson try to meet them?

Shareholder expectations have changed over the years. There hasn’t been as much scrutiny as there is now in terms of the company’s environmental performance. Today, our shareholders are asking: what is the company’s performance or carbon intensity going to look like in the next one year, three years, and five years? Are carbon intensity levels declining? When will your emissions peak? These are the types of questions that we are getting from our financiers and institutional investors.

Yinson was one of the first companies in Malaysia to issue a RM1 billion sustainability-linked bond (SLB) in December 2021, which was oversubscribed by 1.66 times. The issuance was supported by our Sustainability-Linked Financing Framework, pegging the SLB to three Key Performance Indicators (KPIs). These are renewable energy generation, carbon intensity per barrel of oil equivalent, and carbon intensity per unit of electricity generated. As part of our commitment to be accountable and transparent to our stakeholders, we will ensure these KPIs and related performance obtain external assurance and verification annually.

Yinson Production’s Helang FPSO. Image: Yinson.

How do you see the oil and gas industry in Malaysia evolving to adapt to the low-carbon transition risks? What opportunities are there for businesses in this sector?

We believe the key is to approach the transition holistically, orderly and inclusively. Thoughtful business planning and strategies are required to ensure sustainable value creation for all stakeholders.

I do encourage our peers in the energy industry to begin by identifying key climate-related risks and opportunities in their businesses, consider a range of climate scenarios to determine their impact, as well as allocate key resources and develop the necessary skill sets for the transition. Energy companies across the value chain recognise that energy transition is inevitable, and we have seen other key players in the market pivoting and diversifying to other business segments.

It is important to keep in mind that as we transition towards a low-carbon economy, we need to ensure a balance in energy supply for a just transition. Energy is directly linked to the wellbeing, prosperity and development of every economy. At the national level, energy supply does not develop at the same rate everywhere in the country and is affected by factors such as availability, infrastructure, market competition and government policies. Hydrocarbons such as gas will still be needed to fill in the gaps as alternative forms of energy alone cannot fulfill the energy demand of all sections of society. For example, there are approximately 250,000 homes in East Malaysia that lack a consistent electricity supply and rely on hydrocarbons for their energy needs. It is essential for all stakeholder groups to be part of the energy transition conversation so that no one is left behind.

Source: Eco Business